Establishing Shariah Audit Criteria for Zakat Operations: Where to Begin?

DOI:

https://doi.org/10.69526/bir.v3i4.402Keywords:

Audit Criteria, Logic Framework, Shariah Audit, Shariah Governance Framework, Zakat DistributionAbstract

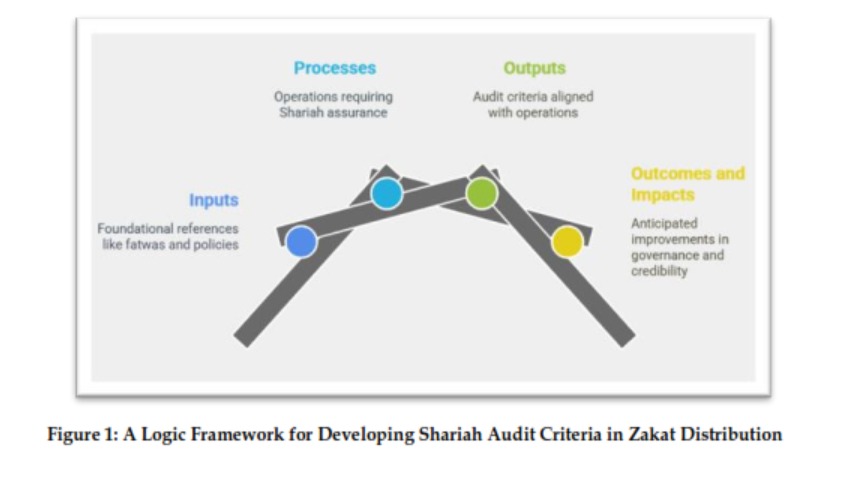

This study addresses the absence of structured Shariah audit mechanisms in zakat institutions, particularly in the operational aspects of zakat distribution. Hence, the objective of the study is to develop Shariah audit criteria grounded in authoritative references such as fatwas, governance manuals, and Islamic finance standards. Adopting a qualitative document analysis approach guided by the Logical Framework model, this study systematically translates key Shariah principles into practical audit criteria. The findings aim to enhance Shariah assurance, improve institutional accountability, and support more consistent zakat governance practices across decentralized systems. This study presents the development of Shariah audit criteria for zakat distribution by integrating documentary sources such as fatwas, governance standards, and institutional SOPs with practical operational considerations. Key findings include a structured set of audit criteria rooted in principles such as comprehensiveness, prioritisation, and data completeness, which were translated into actionable audit tools. The study also identifies critical enablers such as trained personnel, dedicated Shariah committees, and supportive digital systems that are necessary for effective Shariah auditing. Discussions highlight three key governance gaps: the lack of structured Shariah oversight mechanisms, limited legal institutionalisation of Shariah functions, and insufficient stakeholder competency. The study calls for the establishment of a formal Shariah governance framework, aligned with national enactments and supported by a Shariah Audit Competency Framework. Overall, this research contributes to institutionalising Shariah auditing as both a compliance and strategic governance tool in zakat management, fostering transparency, accountability, and public trust in line with the maqasid of zakat.

References

M. S. M. Esa, M. A. M. Noor and H. Wahid, “Cadangan Kodifikasi Akta Zakat Nasional dan Penubuhan Majlis Zakat Negara,” Jurnal Ekonomi Malaysia, vol. 52, no. 1, pp. 153–165, 2018. Doi: http://dx.doi.org/10.17576/JEM-2018-5201-12

H. Wahid, S. Ahmad, M. A. M. Nor, and M. A. Rashid, “Prestasi kecekapan pengurusan kewangan dan agihan zakat: perbandingan antara majlis agama islam negeri di Malaysia,” J. Ekon. Malays., vol. 51, no. 2, pp. 39–54, 2017. Doi: http://dx.doi.org/10.17576/JEM-2017-5001-4

A. A. Sawmar and M. O. Mohammed, “Enhancing zakat compliance through good governance: a conceptual framework,” ISRA Int. J. Islam. Finance, vol. 13, no. 1, pp. 136–154, 2021, Doi: https://doi.org/10.1108/IJIF-10-2018-0116

F. S. Zakiy, F. Falikhatun, and N. N. Fauziah, “Sharia governance and organizational performance in zakat management organization: evidence from Indonesia,” J. Islam. Account. Bus. Res., 2023. Doi: https://doi.org/10.1108/JIABR-06-2023-0188

Bank Negara Malaysia, Shariah Governance Policy Document, Kuala Lumpur, 2019. [Online]. Available: https://www.bnm.gov.my/documents/20124/761679/Shariah+Governance+Policy+Document+2019.pdf

S. Eldersevi and R. Haron, “An analysis of maṣlaḥah based resolutions issued by Bank Negara Malaysia,” ISRA International Journal of Islamic Finance, vol. 12, no. 1, pp. 89–102, 2020. Doi: https://doi.org/10.1108/IJIF-09-2018-0103

S. N. A. Moharani and A. Mustaffa, “Role of the Shariah Advisory Council (SAC) in Dispute Resolution Process: Perspective on Recent Case Development,” Malayan Law J., vol. 6, 2012. Website: https://www.researchgate.net/publication/318528484_Role_of_the_Shariah_Advisory_Council_SAC_In_Dispute_Resolution_Process_Perspective_on_Recent_Case_Development

R. Grassa, “Shariah supervisory system in Islamic financial institutions: New issues and challenges,” Humanomics, vol. 29, no. 4, pp. 333–348, 2013. Doi: https://doi.org/10.1108/H-01-2013-0001

S. Mohamad and Z. U. L. K. Muhamad Sori, “Effectiveness of Shariah committees in the Malaysian Islamic financial institutions: The practical perspective,” MEI Insight IFS, vol. 2, 2016. Website: https://ibir-api.hbku.edu.qa/node/48619

A. A. Othman et al., “Shariah governance for Islamic financial institutions in Malaysia on the independency of Shariah committee and efficiency of its Shariah decisions,” Recent Adv. Manag. Mark. Financ., pp. 93–100, 2013. Website: http://irep.iium.edu.my/38380/

R. Wilson, “Shari’ah governance for Islamic financial institutions,” ISRA Int. J. Islam. Finance, vol. 1, no. 1, pp. 59–75, 2009. Doi: https://doi.org/10.55188/ijif.v1i1.65

F. Jaafar, M. H. M. Tahir and N. J. Ismail, “Strengthening Shariah compliance risk culture,” Financial Stability and Payment Systems Report, pp. 87–90, 2018. Website: https://www.bnm.gov.my/documents/20124/856365/cp03_001_box

R. A. J. Saad, K. Md Idris, H. Shaari, N. Sawandi, and C. Derashid, “Governance of non-profit organizations: A case of zakat institutions in Malaysia,” Int. J. Econ. Res., vol. 14, no. 16, pp. 253–265, 2017. Website: https://serialsjournals.com/index.php?route=product/product/volumeissue&product_id=364&vol_id=77

S. N. Syed Yusuf et al., “Examining technology improvement, procedural application and governance on the effectiveness zakat distribution,” Int. J. Ethics Syst., vol. 40, no. 1, pp. 103–126, 2024. Doi: https://doi.org/10.1108/IJOES-02-2022-0031

Pejabat Mufti Wilayah Persekutuan, “Sistem e-Fatwa Pejabat Mufti Wilayah Persekutuan,” 2025. [Online]. Available: https://efatwa.muftiwp.gov.my/?search=zakat&page=3.

M. I. H. Kamaruddin, Z. Shafii, M. M. Hanefah, S. Salleh, and N. Zakaria, “Exploring Shariah audit practices in zakat and waqf institutions in Malaysia,” J. Islam. Account. Bus. Res., vol. 15, no. 3, pp. 402–421, 2024a. Doi: https://doi.org/10.1108/JIABR-07-2022-0190

N. A. Rahman and M. A. Jusoh, “A review of board of director, shariah supervisory board and zakat distribution performance in Malaysia,” Int. J. Acad. Res. Bus. Soc. Sci., vol. 8, no. 2, pp. 785–794, 2018. Doi: http://dx.doi.org/10.6007/IJARBSS/v8-i2/3985

N. A. Wahab and A. R. A. Rahman, “A framework to analyse the efficiency and governance of zakat institutions,” J. Islam. Account. Bus. Res., vol. 2, no. 1, pp. 43–62, 2011. Doi: https://doi.org/10.1108/17590811111129508

A. Benjamin, “Audit: how to do it in practice,” BMJ, vol. 336, no. 7655, pp. 1241–1245, 2008. Doi: https://doi.org/10.1136/bmj.39527.628322.AD

ASOSAI, Fifth ASOSAI Research Project Performance Auditing Guidelines, 2000. [Online]. Available: https://www.eurosai.org/handle404?exporturi=/export/sites/eurosai/.content/documents/materials/Performance-Auditing-Guidelines-5th-Research-Project-ASOSAI.pdf

R. Batko, “Evaluation of audit criteria for cultural institutions: a research report,” European Research Studies, vol. 24, no. 1, pp. 478–493, 2021. Doi: https://doi.org/10.35808/ersj/1974

L. Legovini, “Development impact evaluation initiative: A world bank–wide strategic approach to enhance development effectiveness,” Draft Rep. to Oper. Vice Presidents, World Bank, Washington, DC, 2010.

J. A. McLaughlin and G. B. Jordan, “Logic models: a tool for telling your program’s performance story,” Eval. Program Plann., vol. 22, no. 1, pp. 65–72, 1999, doi: https://doi.org/10.1016/S0149-7189(98)00042-1.

D. E. Uwizeyimana, “The logframe as a monitoring and evaluation tool for government interventions in a chaotic and complex environment,” Afr. Public Serv. Deliv. Perform. Rev., vol. 8, no. 1, pp. 1–12, 2020, doi: https://doi.org/10.4102/apsdpr.v8i1.328.

D. Roduner, W. Schläppi, and W. Egli, “Logical Framework Approach and Outcome Mapping, A Constructive Attempt of Synthesis,” Rural Dev. News, vol. 2, pp. 1–24, 2008.

MAIDAM, “Laporan Tahunan MAIDAM,” 2021. [Online]. Available: https://www.maidam.gov.my/images/pdf/laporan_tahunan/Buku-Laporan-Tahunan-MAIDAM-2021.pdf

MAIS, “Laporan Tahunan MAIS 2022,” Majlis Agama Islam Selangor, 2022. [Online]. Available: https://mais.gov.my/wp-content/uploads/2024/01/LAPORAN-TAHUNAN-MAIS-2022_Final.pdf

MAIWP, “Laporan Tahunan MAIWP,” 2022. [Online]. Available: https://www.maiwp.gov.my/assets/PDF/publication/laporantahunan/laporan2022.pdf

AAOIFI, AAOIFI Governance Standards (GS 11) – Internal Shari’ah Audit, 2015. [Online]. Available: https://aaoifi.com/aaoifi-gs-11-internal-shariah-audit-final-for-issuance/?lang=en

IFSB, Guiding Principles on Shari'ah Governance Systems for Institutions Offering Islamic Financial Services, Islamic Financial Services Board, Kuala Lumpur, 2009.

JAWHAR, Manual Pengurusan Agihan Zakat, 1st ed. Putrajaya: Jabatan Wakaf Zakat dan Haji, Jabatan Perdana Menteri, 2007. [Online]. Available: https://e-penerbitan.jawhar.gov.my/ManualPengurusan/Zakat/mpaz/book.html.

MIA, “White Papers on Shariah Audit,” Malaysia Institute of Accountants, 2023. [Online]. Available: https://mia.org.my/storage/2023/07/White-Paper-on-Shariah-Audit.pdf

ISRA, External Shariah Audit Report, International Shariah Research Academy, 2016. [Online]. Available: https://www.ukifc.com/wp-content/uploads/2016/10/External_Shariah_Audit_Report_2016_UKIFC_ISRA_Release.pdf

M. S. M. Esa et al., “Measuring Competency Impact on Shariah Audit Effectiveness: A Systematic Literature Review,” 2025a. Doi: https://dx.doi.org/10.47772/IJRISS.2025.9020166

Y. Al-Qaradawi, Fiqh al-Zakah, vol. 2, Muassasah al-Risalah, 1973. [Online]. Available: https://www.islamicstudies.info/literature/fiqhalzakah_vol2.pdf

A. A. Khalid, “Role of audit and governance committee for internal Shariah audit effectiveness in Islamic banks,” Asian J. Account. Res., vol. 5, no. 1, pp. 81–89, 2020, doi: https://doi.org/10.1108/AJAR-08-2019-0061.

R. Masruki, M. M. Hanefah, and B. K. Dhar, “Shariah Governance Practices of Malaysian Islamic Banks in the Light of Shariah Compliance,” Asian J. Account. Gov., vol. 13, pp. 63–70, 2020. Doi: https://doi.org/10.17576/AJAG-2020-13-08)

S. Kaslam, “Governing zakat as a social institution: The Malaysian perspective,” Soc. Manag. Res. J., vol. 6, no. 1, pp. 15–32, 2009. Doi: https://doi.org/10.24191/smrj.v6i1.5166

M. I. H. Kamaruddin, Z. Shafii, M. M. Hanefah, S. Salleh, and N. Zakaria, “Issues and challenges in shariah audit practices in Malaysian shariah-based sectors,” J. Muamalat Islam. Financ. Res., pp. 82–100, 2024b. Doi: https://doi.org/10.33102/jmifr.564

M. S. M. Esa, H. Wahid and S. E. Yaacob, “Revamping Zakat Distribution: Asnaf Empowerment Through Conditional Cash Transfer,” Planning, vol. 20, no. 5, pp. 2055–2064, 2025b. Doi: https://doi.org/10.18280/ijsdp.200522

M. S. M. Esa, S. E. Yaacob and H. Wahid, “A Systematic Literature Review on Conditional Cash Transfers in Organisation of Islamic Cooperation Countries for Tackling Poverty,” Samarah: Jurnal Hukum Keluarga dan Hukum Islam, vol. 9, no. 1, pp. 340–373, 2025c. Doi: https://doi.org/10.22373/sjhk.v9i1.20577

M. Zulkhibri, “The relevance of conditional cash transfers in developing economy: the case of Muslim countries,” Int. J. Soc. Econ., vol. 43, no. 12, pp. 1513–1538, 2016, doi: https://doi.org/10.1108/IJSE-05-2014-0106.

M. SumBillah, “How Does Maqasid Shari’ah Contribute Significantly to Development?,” J. Islam. Bank. Finance, vol. 41, no. 2, 2024. Website: https://scholar.google.com/citations?view_op=view_citation&hl=en&user=McUOQ1IAAAAJ&sortby=pubdate&citft=1&email_for_op=an140%40ums.ac.id&citation_for_view=McUOQ1IAAAAJ:r_AWSJRzSzQC

Downloads

Published

Issue

Section

License

Copyright (c) 2025 Mohd Suffian Mohamed Esa, Salmy Edawati Yaacob, Hairunnizam Wahid (Author)

This work is licensed under a Creative Commons Attribution 4.0 International License.