Contemporary Interpretation of Asnaf Muallaf and Its Management Model: Evidence from Majlis Islam Sarawak

DOI:

https://doi.org/10.69526/bir.v3i4.401Keywords:

Asnaf Muallaf, Zakat Distribution, Islamic Council of Sarawak, ManagementAbstract

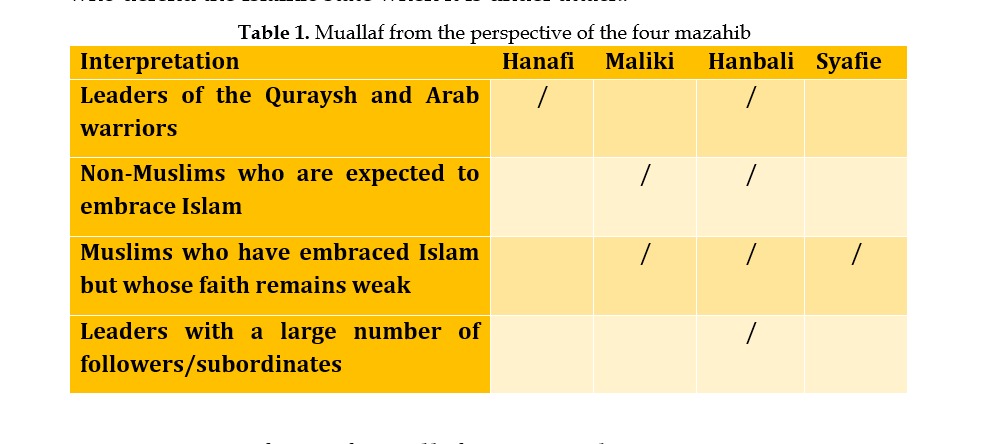

The management and distribution of zakat to the asnaf muallaf (new converts to Islam) represent a critical aspect of social finance. Although discussions regarding muallaf have been ongoing for centuries, there exist diverse interpretations of the asnaf muallaf category among the four major Islamic schools of thought. Various interpretations have been proposed concerning the definition of muallaf and the necessity of continuing zakat distribution to this group. This study aims to explore the concept and management model of muallaf within the Islamic Council of Sarawak (Majlis Islam Sarawak or MIS). Employing a qualitative approach, the study utilizes document analysis and interviews to gather information. The findings reveal that zakat distribution in Sarawak is predominantly focused on muallaf who have recently embraced Islam. However, individuals inclined toward Islam, who are also included in the MIS's interpretation, appear to receive less explicit attention in the implementation of zakat distribution. This study is expected to contribute to the enhancement of asnaf muallaf management in Sarawak and serve as a reference for zakat institutions and religious bodies in improving zakat administration for the asnaf muallaf group.

References

M. S. M. Esa, H. Wahid, and S. E. Yaacob, “Revamping Zakat Distribution: Asnaf Empowerment Through Conditional Cash Transfer,” Int. J. Sustain. Dev. Plan., vol. 20, no. 5, pp. 2055–2064, May 2025, doi: https://doi.org/10.18280/ijsdp.200522.

A. A. Rahman, M. A. Al-Bohari, S. N. Panglima, A. Muhasim, and A. Barrow, “Mekanisma Dan Analisis Skim Agihan Zakat Di Universiti Kebangsaan Malaysia (UKM) Mengikut Maqasid Syariah,” J. Fatwa Manag. Res., vol. 30, no. 2, pp. 162–175, May 2025, doi: https://doi.org/10.33102/jfatwa.vol30no2.677.

M. K. Kossman and K. L. Kucera, “Qualitative methods and mixed methods,” in Translational Sports Medicine, School of Health Professions, University of Southern Mississippi, Hattiesburg, MS, United States: Elsevier, 2023, pp. 233–241. doi: https://doi.org/10.1016/B978-0-323-91259-4.00089-8.

V. M. Welten and A. J. Reich, “Qualitative methods and mixed methods,” in Handbook for Designing and Conducting Clinical and Translational Surgery, Center for Surgery and Public Health, Brigham and Women’s Hospital, Harvard Medical School, Boston, MA, United States: Elsevier, 2023, pp. 281–286. doi: https://doi.org/10.1016/B978-0-323-90300-4.00091-4.

C. Alfonso and Á. Antelo, “Quantitative and qualitative methods, primary methods,” in Environmental Toxicology, Plaza Santo Domingo 20-5a, Lugo, 27001, Spain: De Gruyter, 2018, pp. 58–90. doi: https://doi.org/10.1515/9783110442045-003.

F. Johari, M. R. Ab. Aziz, M. F. Ibrahim, and A. F. Mohd Ali, “Zakat Distribution and Programme for Sustaining Muallaf Belief and Thought,” J. Teknol., vol. 66, no. 1, Dec. 2013, doi: https://doi.org/10.11113/jt.v66.1940.

F. Johari, A. F. M. Ali, M. R. A. Aziz, and N. Ahmad, “The Importance of Zakat Distribution and Urban-Rural Poverty Incidence among Muallaf (New Convert),” Asian Soc. Sci., vol. 10, no. 21, Sep. 2014, doi: https://doi.org/10.5539/ass.v10n21p42.

S. N. M. Ali, S. Mokhtar, A. H. Mohd Noor, N. Johari, N. S. Fauzi, and N. A. Salleh, “A study on integration of Waqf Real Estate and Zakat : A qualitative investigation for Asnaf Muallafs’ welfare,” IOP Conf. Ser. Earth Environ. Sci., vol. 117, p. 012021, Feb. 2018, doi: https://doi.org/10.1088/1755-1315/117/1/012021.

K. Musanna, A. Fitri, Junaidi, Azhar, and A. R. Badruzaman, “Between Doctrine and Custom: A Sociological Study on the Distribution of Zakat to Santri,” Al-Manahij J. Kaji. Huk. Islam, vol. 19, no. 1, pp. 17–30, Apr. 2025, doi: https://doi.org/10.24090/mnh.v19i1.12386.

O. Kane, “Abubakar Dauda. — ‘They love us because we give them Zakāt.’ The Distribution of Wealth and the Making of Social Relations in Northern Nigeria,” Cah. Etud. Afr., vol. 248, no. 4, pp. 901–902, 2022, doi: https://doi.org/10.4000/etudesafricaines.40327.

M. A. Al-Bohari, A. Ab Rahman, and M. F. Abd Shakor, “Analisis Skim Agihan Zakat Di Universiti Tenaga Nasional (UNITEN) Mengikut Maqasid Syariah,” J. Fatwa Manag. Res., vol. 30, no. 1, pp. 199–210, Jan. 2025, doi: https://doi.org/10.33102/jfatwa.vol30no1.669.

H. Abderrahim and E. M. Fadma, “THE EFFECT OF APPLIED ZAKAT ON WEALTH DISTRIBUTION USING AGENT BASED MODELING,” J. Theor. Appl. Inf. Technol., vol. 102, no. 22, pp. 7978–7988, 2024, [Online]. Available: https://www.scopus.com/inward/record.uri?eid=2-s2.0-85211119134&partnerID=40&md5=0706d51b1cd55bbec932bfeadfcd38e5

D. Kamaludin Yusup, D. H. Sobana, and F. Fachrurazy, “The Effectiveness of Zakat Distribution at the National Zakat Agency,” AL-’ADALAH, vol. 18, no. 1, pp. 55–76, Sep. 2021, doi: https://doi.org/10.24042/adalah.v18i1.9912.

S. M. Nor, S. E. Yaacob, A. A. Rahman, and H. Zainal, “Digitizing Zakat Distribution in Malaysia: A Case Study on Application Process at Kedah State Zakat Board,” Samarah J. Huk. Kel. dan Huk. Islam, vol. 8, no. 3, p. 1901, Nov. 2024, doi: https://doi.org/10.22373/sjhk.v8i3.24158.

A. bin A. Alsaadi, “Integration and Development of Zakat Collection and Distribution in the Islamic Finance Industry,” in Impact of Zakat on Sustainable Economic Development, University of Bahrain, Zallaq, Bahrain: IGI Global, 2021, pp. 196–205. doi: https://doi.org/10.4018/978-1-7998-3452-6.ch014.

S. M. Yamaludin, S. F. Syed Alwi, R. Rosman, and M. R. Khamis, “The role of zakat distribution on the sustainability of gharimin (genuine debtors) in Islamic financial institutions in Malaysia,” J. Islam. Account. Bus. Res., vol. 15, no. 6, pp. 988–1008, Jul. 2024, doi: https://doi.org/10.1108/JIABR-01-2023-0004.

H. Oemar, U. Alifani, and Y. Orgianus, “Strategic enhancement of Zakat collection and distribution in philanthropic institutions: integration of SERVQUAL, Kano, and QFD,” Acta Logist., vol. 11, no. 1, pp. 21–32, Mar. 2024, doi: https://doi.org/10.22306/al.v11i1.446.

S. N. Syed Yusuf, N. H. Sanawi, E. K. Ghani, R. Muhammad, D. Daud, and E. S. Kasim, “Examining technology improvement, procedural application and governance on the effectiveness zakat distribution,” Int. J. Ethics Syst., vol. 40, no. 1, pp. 103–126, Jan. 2024, doi: https://doi.org/10.1108/IJOES-02-2022-0031.

M. Md Husin, N. A. Mohd Zamil, and Z. Abdul Salam, “Is Zakat Capable of Alleviating Poverty and Reducing Income Inequality?,” in Advances in electronic government, digital divide, and regional development book series, Universiti Teknologi Malaysia, Johor Bahru, Malaysia: IGI Global, 2021, pp. 168–185. doi: https://doi.org/10.4018/978-1-7998-3452-6.ch012.

R. Ahmad, H. Awang, A. Ramely, and N. A. Zainol, “Online Zakat Distribution during the Pandemic: Did Hotel Employees Find It Helpful?,” Asia-Pacific J. Innov. Hosp. Tour., vol. 13, no. 3, pp. 35–49, 2024, [Online]. Available: https://www.scopus.com/inward/record.uri?eid=2-s2.0-85216094986&partnerID=40&md5=9535308dc3f4214d6e90451539fc8a0c

K. F. Khairi, A. Rafiki, S. N. Rahmadhani, and R. F. Ananda, “Strategies and Applications of Blockchain Technology of Zakat Collection and Distribution in Malaysia and Indonesia,” in Strategic Islamic Business and Management, vol. Part F3298, Universiti Sains Islam Malaysia, Nilai, Malaysia: Springer Science and Business Media Deutschland GmbH, 2024, pp. 19–33. doi: https://doi.org/10.1007/978-3-031-61778-2_2.

A. Alam, R. T. Ratnasari, A. Prasetyo, M. N. H. Ryandono, and U. Sholihah, “Systematic Literature Review on Zakat Distribution Studies as Islamic Social Fund,” J. Distrib. Sci., vol. 22, no. 2, pp. 21–30, 2024, doi: https://doi.org/10.15722/jds.22.02.202402.21.

S. Ashurov, S. M. bin S. J. Alhabshi, A. H. A. Othman, M. Habibullah, and M. S. Muhamad Yusof, “Developing a Conceptual Framework for Zakat Collection and Distribution Impact on Social Welfare Through Implications of SDGs,” in Impact of Zakat on Sustainable Economic Development, International Islamic University Malaysia, Institute of Islamic Banking and Finance, Kuala Lumpur, Malaysia: IGI Global, 2021, pp. 120–138. doi: https://doi.org/10.4018/978-1-7998-3452-6.ch009.

S. Sarif, N. A. Ali, and N. ‘Azzah Kamri, “Zakat for generating sustainable income: an emerging mechanism of productive distribution,” Cogent Bus. Manag., vol. 11, no. 1, Dec. 2024, doi: https://doi.org/10.1080/23311975.2024.2312598.

M. R. B. Rosli et al., “The role of ijtihad in expanding zakat distribution,” J. Crit. Rev., vol. 7, no. 11, pp. 746–749, 2020, doi: https://doi.org/10.31838/jcr.07.11.133.

I. Handriani et al., “Standard operational procedure fund distribution system of zakat infaq and shodaqoh for zakat foundations,” J. Phys. Conf. Ser., vol. 1339, no. 1, p. 012106, Dec. 2019, doi: https://doi.org/10.1088/1742-6596/1339/1/012106.

R. S. Rahmat and M. S. Nurzaman, “Assesment of zakat distribution,” Int. J. Islam. Middle East. Financ. Manag., vol. 12, no. 5, pp. 743–766, Nov. 2019, doi: https://doi.org/10.1108/IMEFM-12-2018-0412.

S. Khan, “A Blockchain based Decentralized Zakat Collection and Distribution Platform,” in 2023 7th International Conference on Software and e-Business, New York, NY, USA: ACM, Dec. 2023, pp. 9–13. doi: https://doi.org/10.1145/3641067.3641071.

N. Ibadi and E. A. Hardi, “Is Human Trafficking’s Victim Receive Zakat as Riqab?: Zakat Distribution at East Java Philanthropic Organizations,” Al-Risalah Forum Kaji. Huk. dan Sos. Kemasyarakatan, vol. 22, no. 1, pp. 1–17, Jun. 2022, doi: https://doi.org/ 10.30631/alrisalah.v22i1.1210.

I. Tlemsani, R. Matthews, and M. A. Mohamed Hashim, “Revisiting Zakat with a distribution of weighted Shapley value,” Int. J. Islam. Middle East. Financ. Manag., vol. 16, no. 6, pp. 1141–1158, Oct. 2023, doi: https://doi.org/10.1108/IMEFM-11-2022-0430.

M. Faizin, S. S. Karimullah, B. T. W. Faizal, and I. H. Lubis, “Development of Zakat Distribution in the Disturbance Era,” J. Ilm. Mizani Wacana Hukum, Ekon. Dan Keagamaan, vol. 10, no. 2, p. 196, Apr. 2024, doi: https://doi.org/10.29300/mzn.v10i2.2997.

K. Ahmad and M. H. Yahaya, “Islamic social financing and efficient z akat distribution: impact of fintech adoption among the asnaf in Malaysia,” J. Islam. Mark., vol. 14, no. 9, pp. 2253–2284, Aug. 2023, doi: https://doi.org/10.1108/JIMA-04-2021-0102.

Z. Azhar, M. K. K. Mydin, and A. A. Pitchay, “Zakat Distribution Priorities in Malaysia: An Analytic Hierarchy Process Analysis,” Asian J. Bus. Account., vol. 16, no. 1, pp. 69–87, Jun. 2023, doi: https://doi.org/10.22452/ajba.vol16no1.3.

H. A. Akinlabi and A. A. Habeebullah, “Implementation of Zakat Collection and Distribution System in Ibadan Metropolis Using WordPress Core Architecture and Architectonics,” Fountain J. Nat. Appl. Sci., vol. 11, no. 1, pp. 22–28, Jun. 2022, doi: https://doi.org/10.53704/fujnas.v11i1.444.

S. A. Shaharuddin, M. Y. Marlon, M. A. Majid, A. H. Usman, F. Sungit, and Z. A. Hamid, “THE RELATIONSHIP BETWEEN IMPACT OF ZAKAT DISTRIBUTION AND RELIGIOUS PRACTICE AMONG MUALLAF IN SELANGOR,” Humanit. Soc. Sci. Rev., vol. 7, no. 4, pp. 371–376, Sep. 2019, doi: https://doi.org/10.18510/hssr.2019.7448.

Jumailah and Ahmad Fauzan, “The Effectiveness of the Implementation of the Norms for the Distribution of Zakat Funds in BAZNAS of Pekalongan City (Articles 25 and 26 of Law No. 23 of 2011),” J. Huk. Islam, vol. 20, no. 2, pp. 305–328, Dec. 2022, doi: https://doi.org/10.28918/jhi.v20i2.2274.

N. ’Iffah M. A. Zaaba and R. Hassan, “The Practice of Islamic Bank in Zakat Distribution: The Case of Malaysia,” in Innovation of Businesses, and Digitalization during Covid-19 Pandemic, vol. 488, B. Alareeni and A. Hamdan, Eds., International Islamic University Malaysia, Institute of Islamic Banking and Finance, Kuala Lumpur, Malaysia: Springer Science and Business Media Deutschland GmbH, 2023, pp. 183–193. doi: https://doi.org/10.1007/978-3-031-08090-6_10.

M. Usman, “Zakat Distribution for Handling Transgender in Indonesia: A Perspective of Maṣlāḥah Mursalaḥ,” Samarah J. Huk. Kel. dan Huk. Islam, vol. 7, no. 1, p. 357, Mar. 2023, doi: https://doi.org/10.22373/sjhk.v7i1.16934.

A. Sharofiddin, A. H. A. Othman, and S. M. S. J. Alhabshi, “The impact of zakĀt distribution on social welfare: A case study of selangor zakĀt agencies, Malaysia,” Al-Shajarah J. Int. Inst. Islam. Thought Civilis., vol. 2019, no. Special Issue Islamic Bankingand Finance 2019, pp. 147–167, 2019, [Online]. Available: https://www.scopus.com/inward/record.uri?eid=2-s2.0-85078311366&partnerID=40&md5=7d5c3dac4118af721edfadfeca0f40d5

Z. Zainuddin and S. Salle, “DISTRIBUTION OF ZAKAT FOR CORRECTIONAL INMATES AS AZNAF RIQAB AT BAZNAS OF BARRU DISTRICT,” Diponegoro Law Rev., vol. 8, no. 1, pp. 1–13, Apr. 2023, doi: https://doi.org/10.14710/dilrev.8.1.2023.1-13.

A. Ab Rahman et al., “Analisis Pentafsiran Mualaf Menurut Islam dan Enakmen Pentadbiran Agama Islam Negeri di Malaysia,” مجلة إدارة و بحوث الفتاوى, vol. 6, Dec. 2015, doi: 10.12816/0029903.

M. Mukarram Ibn Manzur al-Ifriqi al-Misri, Lisan al-‘Arab. Beirut: Dar al-Bayrut.

A. Ab Rahman and H. Abd Khafidz, Ensiklopedia Asnaf Dan Skim Agihan Zakat di Malaysia. Bandar Baru Nilai: Universiti Sains Islam Malaysia, 2015.

S. Ismail, “Kesan Agihan Zakat Terhadap Tahap Keagamaan Dalam Kalangan Mualaf Orang Asal Di Pahang,” Master, University of Malaysia, 2018.

M. N. Md Ismail and N. A. Ali, “Konsep Asnaf Mualaf dan Had Pengukuran Mualaf Asnaf Mualaf Concept and Mualaf Measurement Limits,” Al-Basirah Journal, vol. 13, no. 1, pp. 25–41, Jun. 2023, doi: 10.22452/basirah.vol13no1.3.

Yusuf Al-Qaradawi, Fiqh Az-Zakat: A Comparative Study. Jeddah: Scientific Publishing Centre, King Abdulaziz University, 1999.

al-Marghinani, Al-Hidayah fi Sharh Bidayat al-Mubtadi, vol. 2. Beirut: Dar Ihya’ al-Turath al-‘Arabi.

W. Al Zuhaili, Al-Fiqh al-Islami wa Adillatuhu , vol. 2. Damsyik: Dar al-Fikr, 1985.

M. bin I. Al-Shafi‘i, Al-Umm, Muhammad bin Idris, vol. 4. Kuala Lumpur: Institut Terjemahan & Buku Malaysia, 2013.

M. al-D. A. M. A. A. ibn A. Ibn Qudamah, Al Mughni, vol. 6. Cairo, 1968.

Downloads

Published

Issue

Section

License

Copyright (c) 2025 Fadzil Hazim Samah, Nik Abdul Rahim Nik Abdul Ghani (Author)

This work is licensed under a Creative Commons Attribution 4.0 International License.